Company Brief

PT Sarana Majukan Ekonomi Finance Indonesia (SMEFI) is a non-bank financial institution engaged in financing (multifinance) for small and medium enterprises (SME), as a form of commitment to support economic growth for Indonesian society. Established in 2011 based on a license from the Ministry of Finance and BAPEPAM-LK with Decree No: KEP-425/KM.10/2011 and holds a financing business license from OJK with No: KEP-76/NB.11/2022. SMEFI is also supported by digitalization technology and professional, experienced and integrity human resources.

Objectives & Solutions

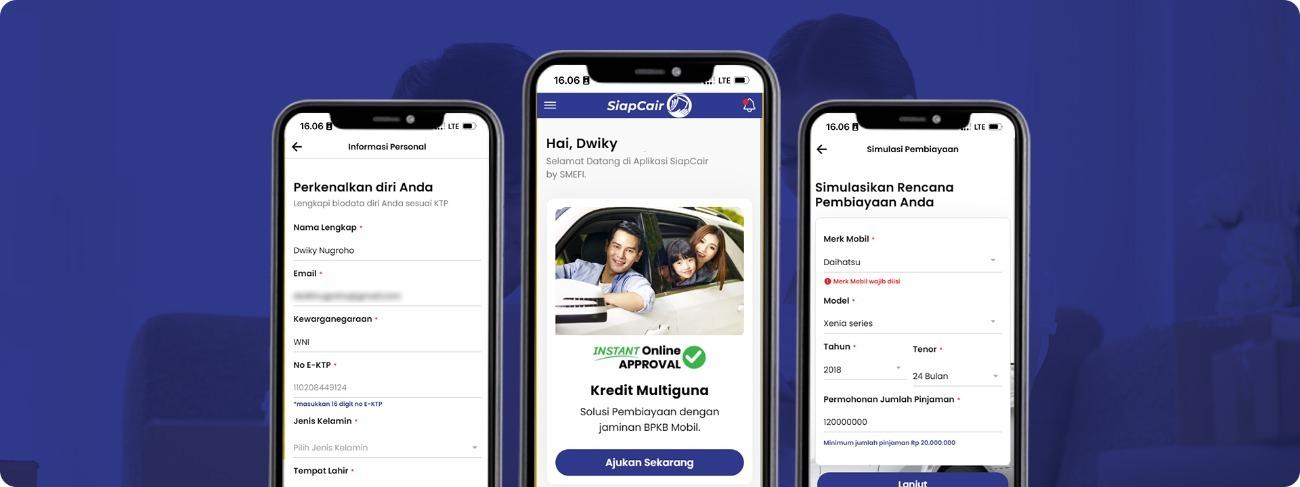

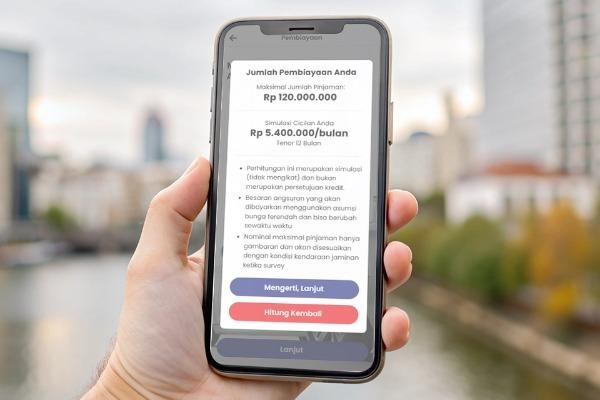

SMEFI is a company that has strong experience in financing services with a complete financial ecosystem with a strong property base, has a vision to become one of the largest financial institutions that can reach all regions of Indonesia. To support the achievement of this vision, SMEFI developed the SiapCair platform which is supported by the integration of internal and external APIs, this can optimize and automate the processes that occur in it, so that the ultimate goal of getting instant approval can be achieved.

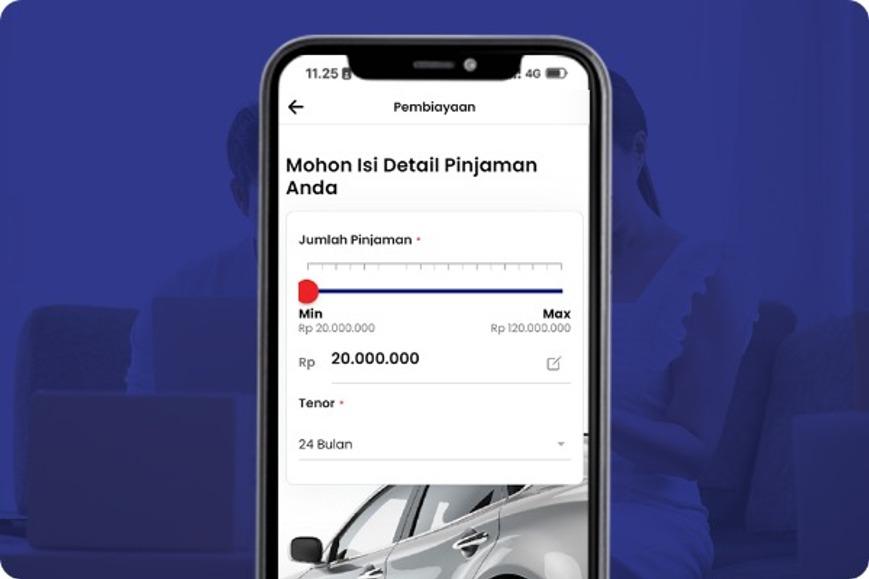

SiapCair is a mobile application that aims to provide financing facilities to customers with a four-wheeled vehicle (car) certificate/BPKB as collateral. Through this application, it allows customers to get instant pre-approval of financing.

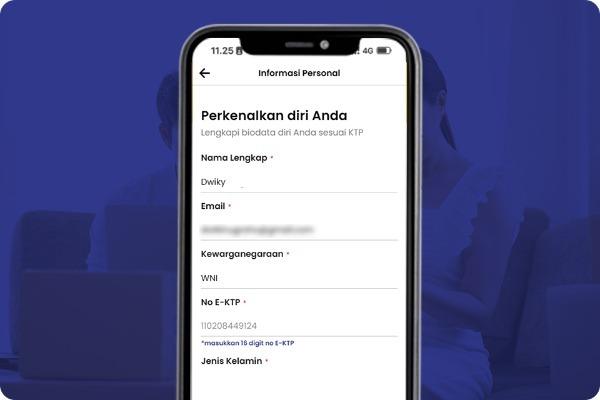

Fast and Easy to Apply a Loan

Users only need to enter personal data and connect one of transaction accounts and income accounts. The system does not store account credentials, only gets read-only access and can only read data within 5 minutes, so user accounts remain secure. These connected accounts are part of the credit analysis automation process, so users can immediately know the maximum credit that can be applied for.

Integrated with Various Applications

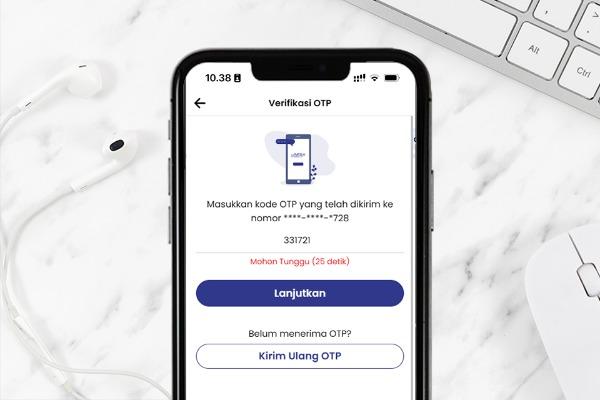

Instant Approval is a financing approval program with an easy and fast credit application process. To support this, SiapCair application has been integrated with various supporting applications to check customer data such as Dukcapil, Profind, and SLIK.

Adjust Credit Analysis Parameters Dynamically

Our client can adjust the credit analysis parameters in accordance with applicable regulations. The system will process the data filled in by the user and automatically calculate it based on the predetermined parameters. This can make it easier for our client to determine the next step.

Easy to Operate

An app that is difficult to use or navigate can quickly become frustrating for users, leading them to abandon it in favour of something more user-friendly. To that end, we made the look and experience of using the SiapCair mobile app as easy as possible to operate even by novice users.

Informative and Responsive Microsite

SiapCair is supported by a microsite to provide all information related to the application. This microsite can be accessed anytime and anywhere. We created the SiapCair microsite with a responsive design concept so that it is easily accessible on all devices. The layout, images, and text automatically adjust to the screen size, making it easy to navigate and read on any device.

Related Works

We believe good ideas deserve a chance to grow. We believe people deserve to earn a living doing what they love.

Our Clients

Over 10 years of delivering the best work and still continuing!

Back to Our Works

Back to Our Works