Company Brief

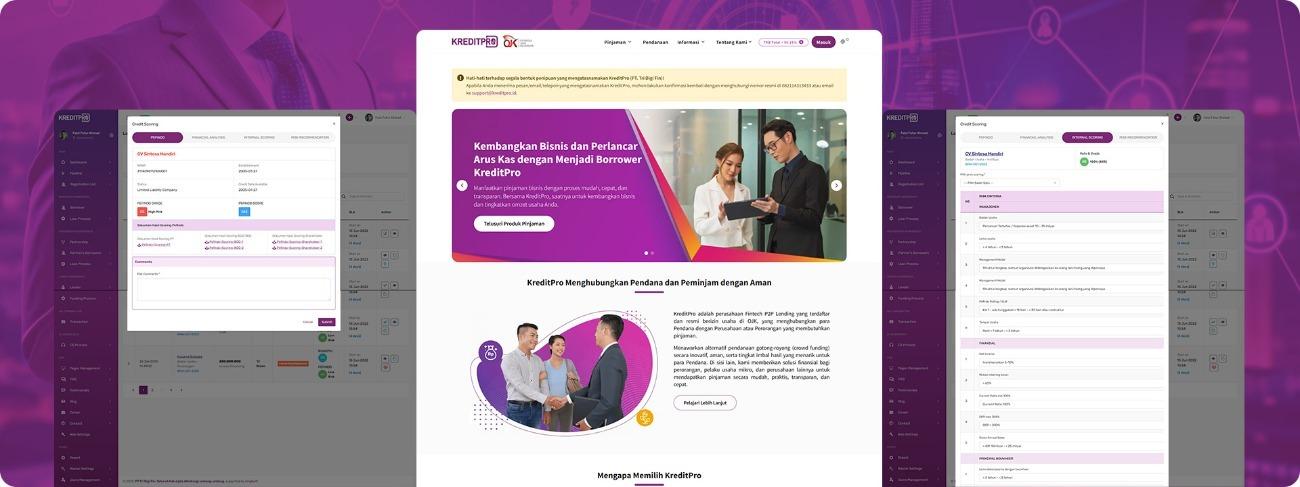

KreditPro is a company engaged in financial technology, which focuses on the peer-to-peer lending business. As a platform for Lenders and Borrowers, KreditPro is envisioned to provide better, innovative, and secure solutions for its users without going through the intermediaries of banks or other financial institutions.

Objectives & Solutions

During the course of its business, KreditPro manually tracked and monitored the process of each transaction. However, with the rapid growth of digital technology, new regulations have emerged from official institutions that require Fin-Tech companies to conduct processes and deliver reports digitally. To comply with these requirements, KreditPro requires system customization and development. PT Tri Digi Fin entrusts Lingkar9 to develop an effective and efficient KreditPro application to enhance company performance.

For the KreditPro team, the development of the KreditPro application aims to make it easier to track the process of each transaction, from registration of Borrower / Lender accounts, credit scoring processes, funding, billing to reporting.

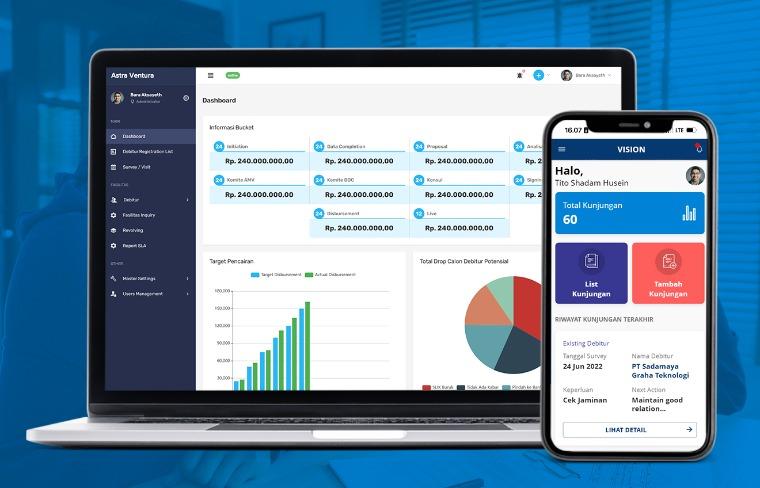

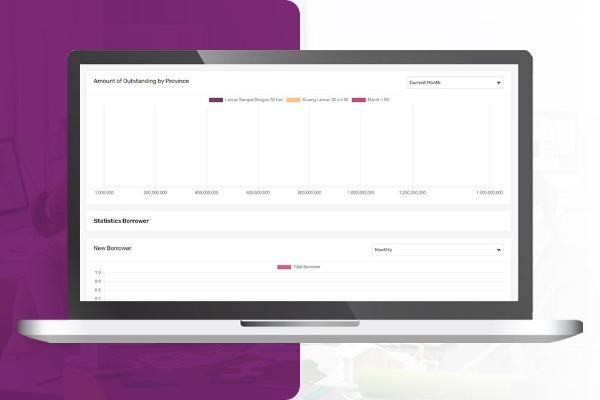

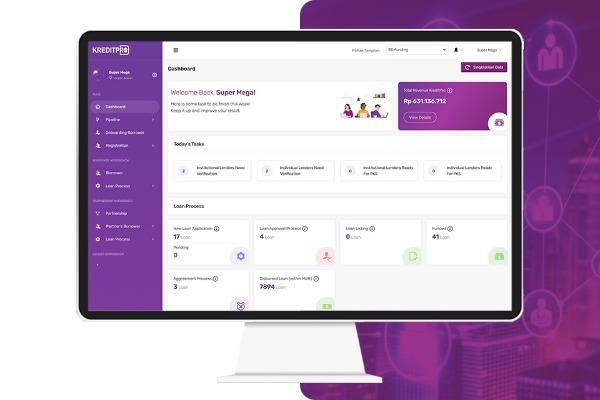

Comprehensive Dashboard

A comprehensive and easy-to-interpret dashboard is the primary thing that must be fulfilled to make the team monitor every transaction process easier. We created a dashboard that shows financing, funding, Borrower, and Lender statistics, presented in graphs with a tailored format to the data content that makes it easier for the team to make decisions and planning.

Integration with Third-Party Apps

KreditPro is integrated with Pusdafil, Pefindo, FDC, Privy, KasPro, SIMAS, Whatsapp Business OTP, and Twilio which facilitates transaction activities, starting from account registration, agreement document signings, credit scoring, funding, return, collection, and reporting that must be reported to official institutions. All accommodated in 1 application thus increasing the productivity of the team.

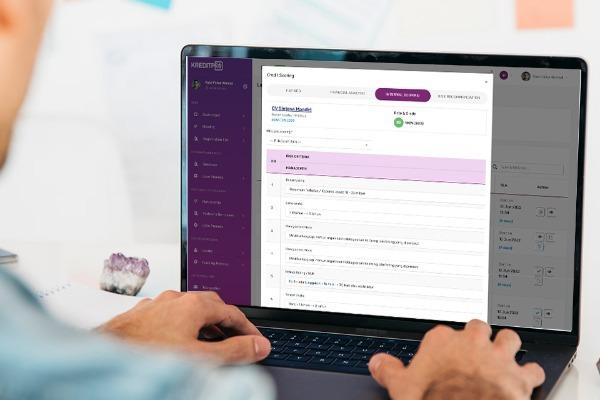

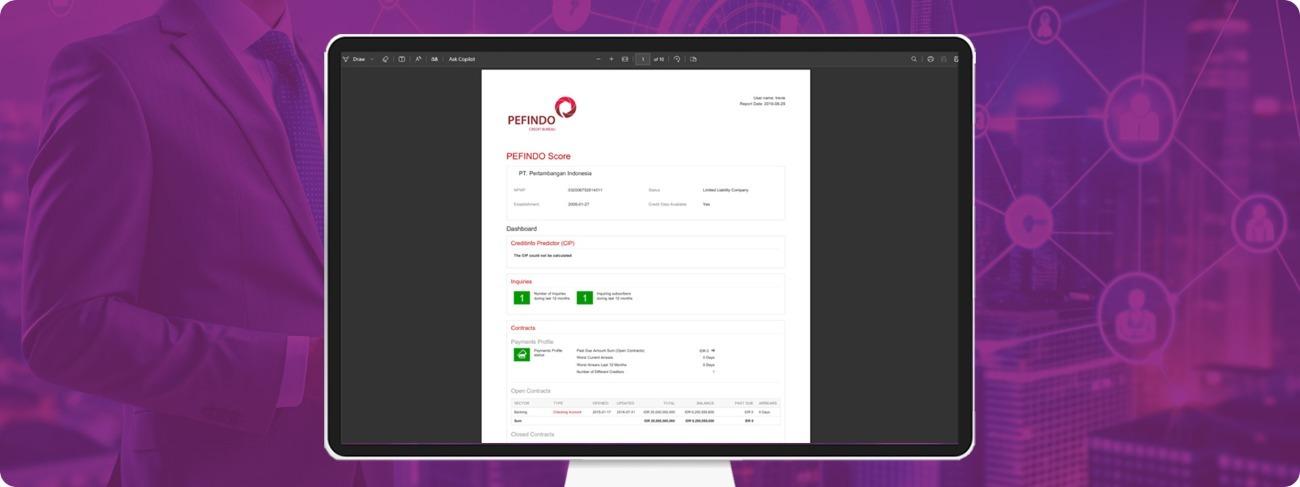

Credit Scoring

Credit Scoring is one of the vital activities carried out by a Fin-Tech company to assess the eligibility of a borrower to receive a loan. The KreditPro team can automatically conduct scoring by looking at Pefindo's scoring results. In addition, scoring is also done manually by assessing the scoring parameters set by the management. We create a comprehensive scoring interface that is user-friendly.

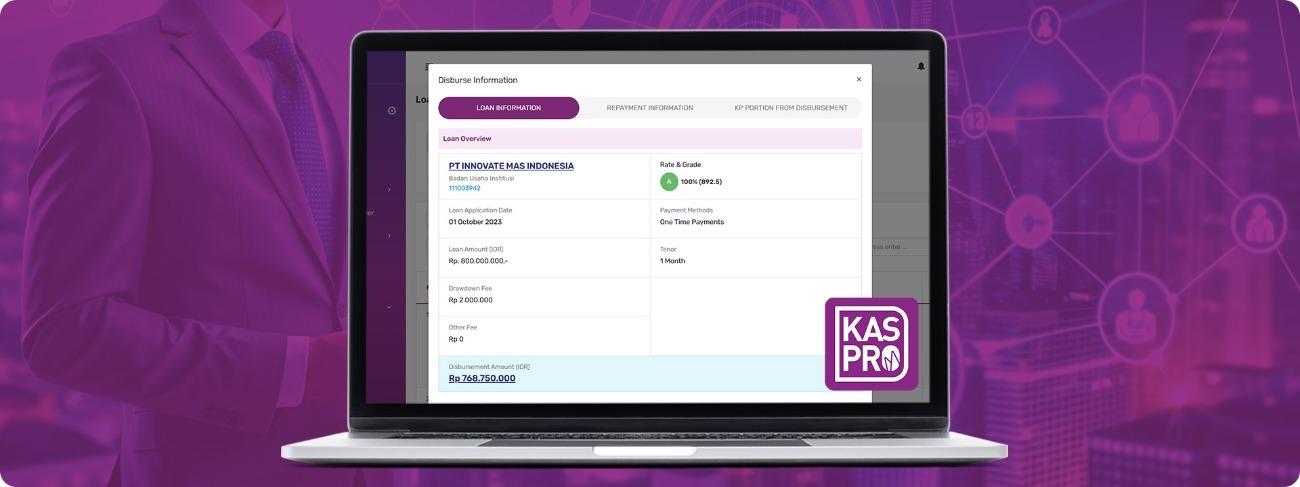

Automatic Borrower's Disbursement / Lender's Return

Disbursement to Borrower and return to Lender can be performed automatically because KreditPro application is integrated with KasPro. Funds can be directly received by Borrower/Lender without the need to transfer funds manually. Users can also see a complete history of transactions in and out of funds.

Partnership & Partner's Borrower

Partnership is a service provided by KreditPro where KreditPro collaborates with companies that provide MSME financing (hereinafter we call Partners's Borrower) and acts as a channel of funds from Lenders to the Partner's Borrower. This application facilitate transaction activities between KreditPro, Partners, and Partner's Borrower to be easier and more flexible where the KreditPro team can disburse and collect the funds directly to Partner's Borrower or through Partners.

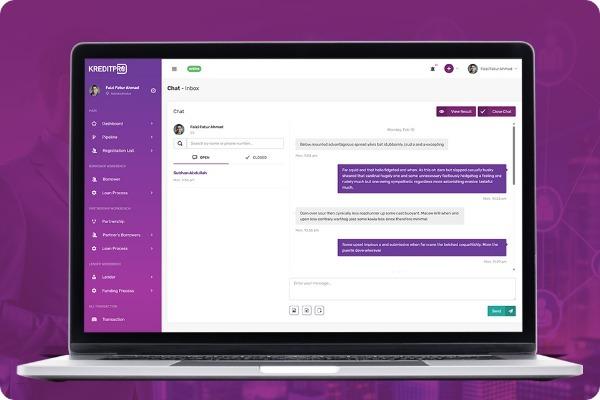

Live Chat Customer Service

Responsive customer service is key to establishing customer trust. We created a Live Chat feature on the KreditPro app where website visitors can send messages directly and received by the KreditPro CS team at the same time so they can receive feedback quickly. The KreditPro team can also fill in the results of the “chat”.

Voice over Internet Protocol (VoIP)

To facilitate loan collection activities, KreditPro app is equipped with a VoIP feature called 'Call Borrower'. The KreditPro team can conduct collections over the phone in the KreditPro app. This Twilio-integrated feature also stores history and records conversations so that the team can easily track collection activity logs.

Integrated Report

As a Fin-Tech company, there are many reports requested by official institutions such as OJK and AFPI. The KreditPro app is integrated with Pusdafil and FDC so reporting is done automatically through the app and sent directly to the relevant agencies.

Easy to Operate

An app that is difficult to use or navigate can quickly become frustrating for users, leading them to abandon it in favor of something more user-friendly. To that end, we made the look and experience of using the KreditPro app as easy as possible to operate even by novice users.

Related Works

We believe good ideas deserve a chance to grow. We believe people deserve to earn a living doing what they love.

Our Clients

Over 10 years of delivering the best work and still continuing!

Back to Our Works

Back to Our Works